Step 1: Download Alipay on your Google Store or Apple Store. Alipay accepts credit cards including VISA, MasterCard, JCB, Diner Club International, and American Express (AMEX). So, you might be wondering what types of international credit cards.

In November 2019, Alipay launched its international version of the mobile app that supports international credit cards. For example, for a Singaporean company, Stripe’s charge is 2.2% + S$0.35. They charge a fixed fee + a percentage fee for each transaction.

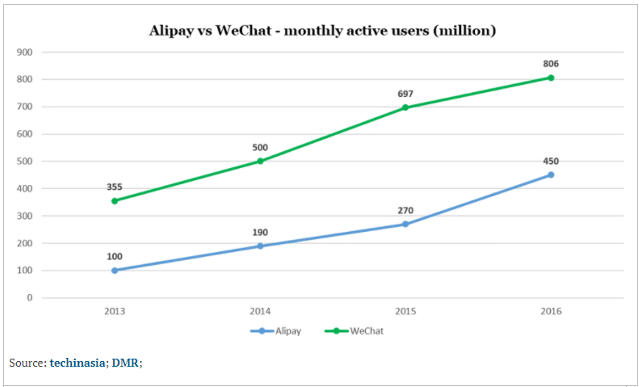

Alipay vs wechat pay software#

Their software supports the transactions in every way (technical, banking, etc.) and they assume all the risks for you. There are those who require you to open a Merchant account yourself, and those who offer you theirs, e.g. Payment gateways, which play an intermediary role between you and the client, are e-commerce service providers, facilitating the way you make and get e-payments.

To do that, you will have to turn to a payment gateway, a company that will become an intermediary for your e-transactions. However, you can’t transfer the money directly to your Merchant Account via Alipay/WeChat Pay. Additionally, in order to cover possible transaction risks, the bank will most likely require a deposit.

However, one might find this option too time-consuming: in order to open a Merchant bank account, a bank would usually require a copy of your company profile from the ACRA database, and then they might require as many additional documents on your business activity as they want until they are satisfied with your credibility. Here’s an example of a form you will need to fill in: Most Singaporean banks offer you this option and it’s usually used for e-payments. Without Opening a Chinese Bank Account Get a Merchant Account in a Singaporean Bank + Payment GatewayĪ Merchant Account allows a company to get and process credit & debit card payments from its clients and partners.

0 kommentar(er)

0 kommentar(er)